Time to Rebalance

Hello Friends,

With the last two notes, we are set with the structure to address most of the needs of the readers. But let the feedback keep coming and make us better with every passing moment.

In this note, we will try to share some thoughts on changing times in the investing world and needs to change with times. And as always we present how things have shaped in the last few weeks. And then share our thoughts on the possible way forward in the coming weeks.

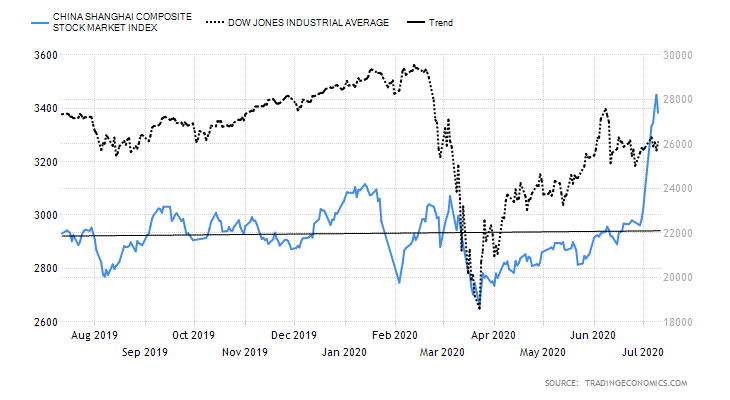

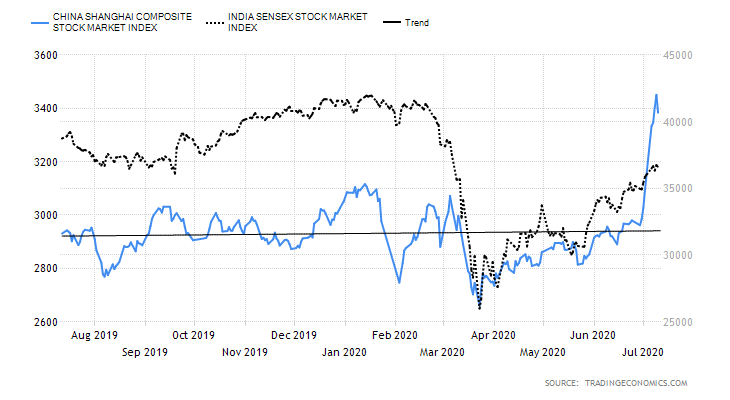

The action shifted in the last few weeks to China for various reasons. Chinese markets have rallied beyond expectations of any investment analyst in the world. Let’s look into what this rally of 14% in two weeks on Chinese Index has done for the Chinese stock market through comparative charts of US and Indian Indices.

What could not happen in a year has happened in two weeks.

Shanghai Composite Index Vs Dow Jones Industrial Averages (USA) Shanghai Composite Index Vs BSE Sensex

Shanghai Composite Index Vs BSE Sensex

Why the sleeping dragon came up flying all of sudden?

Why the sleeping dragon came up flying all of sudden?

Was it de-escalations of border tensions?

Was it related to economic recovery and PMI numbers?

Or was it something else.

Moving a large market by such percentages in a short span of time is eye-catching and unusual.

In the week, however, the Shanghai Composite surged 7.3%, after an article in the state-owned China Securities Journal published earlier in the week encouraged investors to foster a “healthy bull market”, raising investment appetite of the individual investors. Hopes of further fiscal and monetary support and higher debt yields have lifted the mood.

A similar surge happened in 2015 when state-run media fuel the enthusiasm and stocks were bought on margin funding (borrowed money) and then came curbs and a crash of 40%. Will it repeat? Difficult to say at the moment.

There is something for us in this rally in China:

Metals market may rally and give the opportunity to benefit from this awareness of action in China. Oil may also spike up following action in the industrial metals complex. Global ETFs can be evaluated for this strategic allocation. These are absolute returns strategies and thus vary drastically from comparative returns strategies.

As we have a combination of poor economic outlook but the gush of liquidity pumped into the system by central bankers, we would have volatile markets going forward. Choose the asset allocation based on your risk profile and work on your absolute returns plans rather than relying upon AMC's who are concerned about comparative performance.

We have a short note on difference between absolute returns and comparative returns.

The action on rebalancing can be seen in all the AMC’s and HDFC leads the space. It is the right step forward. This action is important to be consistently ahead of the benchmark index.

HDFC AMC offloads winners of the first leg of the rally, turns to next lot

With the fear of war slowly fading away the need to look beyond will guide us to look-out for next growth drivers. India will have a high GDP Deficit and the current poor state of the economy will lead to historical decisions like government borrowing directly from RBI. This shall lead to a flush of funds with PSU’s and thus allow the government to fund the economic activities.

But such action will lead to pressure on the currency. In the current world where we have the excessive print of money by central bankers across the globe, determining currency pair rates is going to be equally challenging. At least fiat currencies like USD, EURO, and JPY would have higher volatility.

Drop a line to [email protected] seeking assistance in designing currency hedges for these challenging times. We are good at designing hedge plans for SME, MSME’s and IT companies for their advantage and slashing off bank transaction cost to a great deal.

Market Commentary

Quarterly results season is around the corner, this quarter will be exceptional with the impact of lockdown. Volatility should be at its highest, need to navigate carefully.

Equities:Globally equities would witness pension fund selling, a usual action of quarterly rebalancing by pension funds. It will have significance as the size of selling will be higher this time. It goes to carry out a rebalancing exercise on your equity portfolio as mid-cap and small-cap have risen substantially. Be careful, when the US market rally again and again on similar statements by Gilead Science on Virus drug, then it looks like a pump and dump may be in action.

Currencies:US Dollar and Euro might remain weaker and thus we maintain our positive bias towards GBP and Yen. USDINR pair is better hedged as we don’t know how government borrowing will shape up. IMF is estimating that India’s debt will reach 85% of the GDP from 72% due to the acute shortfall in government revenues.

Crude OilRally in China can trigger a few days of up move in Crude oil too. Such short and sudden surprise spike can be traded through exposure in oil ETFs XOP, XLE and UCO. Oil and other industrial commodities will remain our favorite long term buy on dips as we believe supply-side shock is unavoidable.

Metals: Gold Silver CopperGold and Silver have shown tremendous capital allocation, the next possible move of $1900 on Gold and $21 on Silver is important to maintain this rhythm. The euphoria can give space to a snap decline, so be ready to lap it up. Real rally in precious metals will be after we cross $2000 and $22 on Silver, so hold on the allocations to ride the absolute gains.

Our favorite will be the ETFs DSP World Gold Fund, GDX and GDXJ.

Copper and other industrial metals Copper have been moving up consistently and we believe Zinc and other metals will also catch up. Copper has resistance at $6500 on LME but it will fuel a rally wide enough for other metals. You can play this move with allocation to mining stocks or direct exposure to commodities derivatives. Major of the move is connected to the firming up of demand in China so have a close watch on China and news from there on industrial activities.

AdvisoryThese are information, views of best of minds, and my humble opinion, take the trade and investment decisions based on your risk profile, objectives and asset allocation. There are times we need to sit on cash and wait for the market to correct and there are times when we have to stay invested and allow the market to move up. In short, inaction in the market is the most rewarding act, once you are set on a clear plan. So fill up buying orders on asset class where there is a need to allocate funds and reduce priced up assets to keep cash for better times.

This is a complimentary note and can be circulated with friends and family members. Advisory is always one to one and this note has no relation to the advisory. We may share views but this piece is not to be considered as advisory. A note may have mention of various authors/videos/views, which are sourced from the internet and respective owners own them and have made it available free for all, it is reproduced here for awareness.

You can drop a mail to [email protected] for blocking time for your queries on taking things forward and working together on any of our core services.