Today we are starting a new chapter to our advisory services. It is an info letter on matters which can help individuals, corporations, investors and traders.

The thought is to present to you pieces of the best of minds in the industry. I am not matured enough to curate whole info letter on my own so thought to collate the best curates for you at one place. I shall add my commentary to such a piece of work, events of geopolitical scenarios, etc;

That’s the reason I would not name it as newsletter and like it to be called as info letter at this point of time. Honestly, haven’t thought about the periodicity of this letter. Will it be weekly, fortnightly, monthly or based on the occurrence of important events?

You can suggest your thoughts about the same.

The info letter will cover macro aspects of global financial markets and strategies built around it. India will also have its due space in the letter. More important would be to filter sound out from the noise, thus it will have very limited topics which matter most and coming from best of unbiased minds of the world.

So take it as information coming from best of collective minds in the industry and use it as suitable to you.

In today’s letter, let me present how things have shaped in the last few weeks.

From industrial commodities to equities market rallied across the board. Dow rallied 800 plus points on Friday on the back of shockingly positive US employment data. Dow had longest 50 days rally in the history in one of the worst economic, health and socio-political environment. This rally has triggered FOMO (Fear of missing out) emotions and which would have forced many investors to jump the bandwagon.

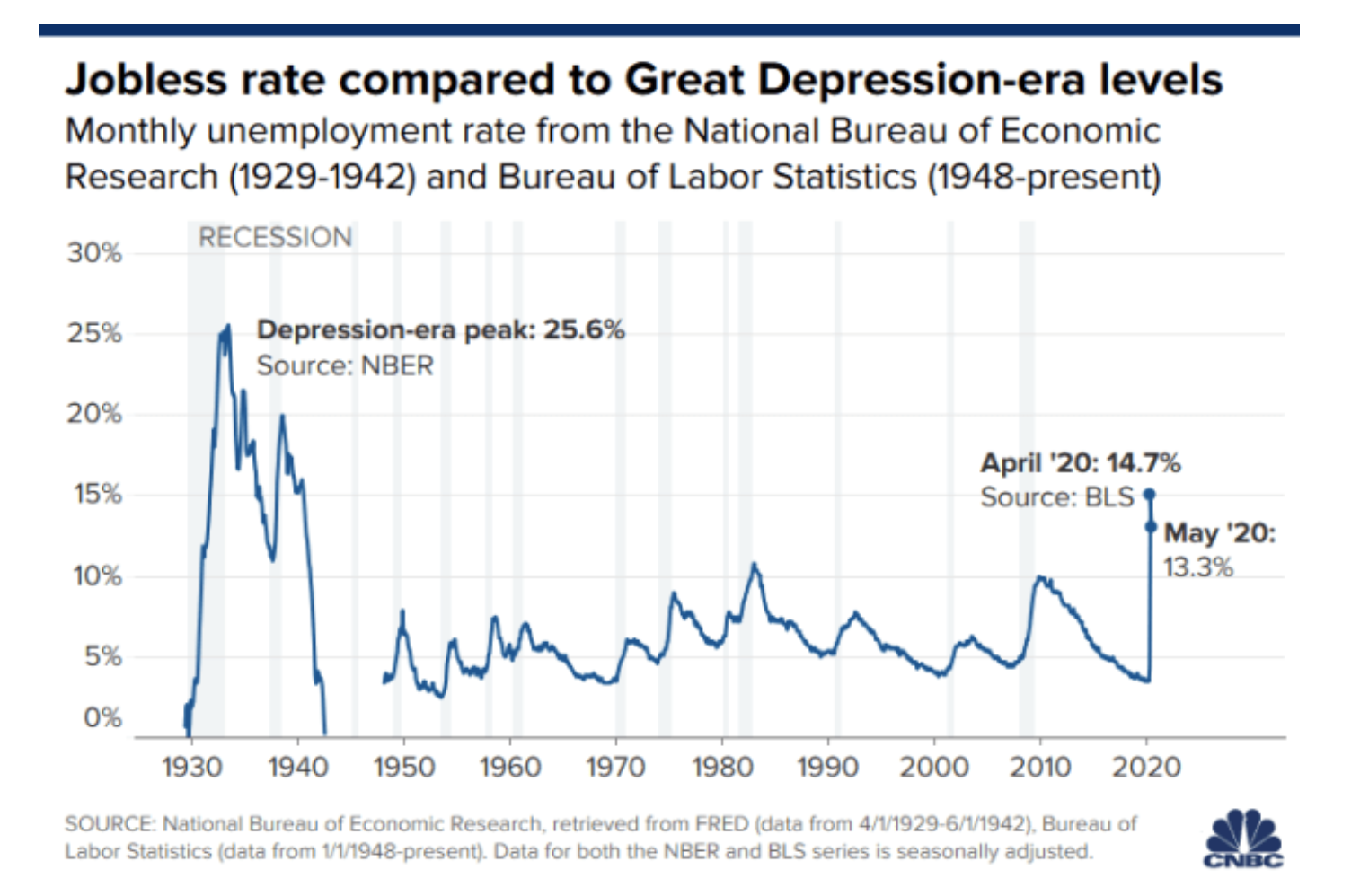

I would like to share fundamental and technical expert’s opinion today on how to view this surge. The data of unexpected positive numbers of US employment was always doubtful. After reading around, found this piece of article on CNBC which spelt out that the Bureau of Labor Statistics has admitted that they made an error in treating furloughed workers numbers and the real unemployment rate is likely to exceed 16%, way contrasting 13% addition to the employment rate.

Here’s why the real unemployment rate may be higher than reported – CNBC Report

Social unrest and the unemployment data points to a bleak picture on the fundamental aspect, now let’s look at what technical analysis helps in understanding the state of the market.

Today I would share videos of Chris Vermeulen a technical analyst and founder of the technical traders.com and Anthony Crudele a renowned trader in the market.

Chris explains precisely how the rally will suck in the FOMO emotional investors into the market before it falls off from the cliff. In his 8 minutes video, WOW, look at this huge setup unfolding in S&P 500. Squeeze the FOMO !! , you will learn how charts display out emotional responses of the market players.

In long run market moves on fundamentals but in short term market moves on sentiments of short term traders, which is nicely expressed by Anthony’s guest on his show. Through market profiling tool, he highlights that long term investors have reduced positions and the current market movement is supported by short term traders. Thus, warning that once this setup is over, we shall see spiral down and that’s where long term investors might come back.

Commentary

With these inputs, we believe we will see very interesting week ahead. On global markets, we may see a last leg of short term commodity rally so long positions can be trimmed in industrial commodities and size up trade allocation to precious metals.

Equities

Globally equities will have last short term up move and fizzle off; same will apply to Indian equities as we may still have steam to hit 10300 to 10500 ranges. But as market profile tool is indicating that the drive is due to short term traders so the reversals are also quick. It would be more of no invest range for now and traders can take positions as per the swing data

Currencies

US Dollar might have started its secular bear market move after collapsing from 99 to 96 in last few weeks. But we would term it secular after we see it going to 95 and below as 3Yr Moving average is around 95.50 so keep a check on that. EURO, AUD may show mild weakness against GBP, Yen and other major currencies.

Crude Oil

Rigs closed, frackers shut and OPEC+ Production cuts has worked well to get us to 40. The trend can take us to 48. But that time around we would be reducing our exposures to oil ETFs XOP, XLE and UCO as the run up has been upward of 200% from their recent few month lows.

Metals: Gold Silver Copper

Gold has trimmed almost 10% from their high in spot market and the ETFs GDX and GDXJ has come down more than 15% from their highs but they are still higher than our entry rates. Dollar weakness, social unrest and debt concerns may add fuel back to precious metals. So start allocations on Gold ETFs and fill the desired allocation percentages.

Silver is very exciting at the moment as 3 Years average comes around 16 and it is well poised to touch 20 in case of economic recovery or even on gloomy debt cycles. Thus silver is better bet for now so ETF of miners are in our list of addition.

Copper has been approaching the 2.50 level and we believe it will take a breather for now with a new peak in the coming week. So we can keep in plan reduction on the ore mining stocks bough few months back. Rio tinto and BHP bilton has been our favorite industrial metal play.

Advisory

These are information, views of best of mind and my dump and humble opinion, take trade and investment decisions based on your risk profile, objectives and asset allocation.

There are times we need to sit on cash and wait for the market to correct and there are times when we have to stay invested and allow market to move up. In short, inaction in market is the most rewarding act, once you are set on a clear plan.

So fill up buying orders on asset class where there is need to allocate funds and reduce priced up assets to keep cash for better times.

This is a complimentary info letter and can be circulated with friends and family members. Advisory is always one to one and this info letter has no relation to advisory. We may share views but this piece is not to be considered as advisory.